| Article Content | Open the EasyCDF or HUD you are working on.

- From the top toolbar, click on “Tools” and then select “Tax Prorations”.

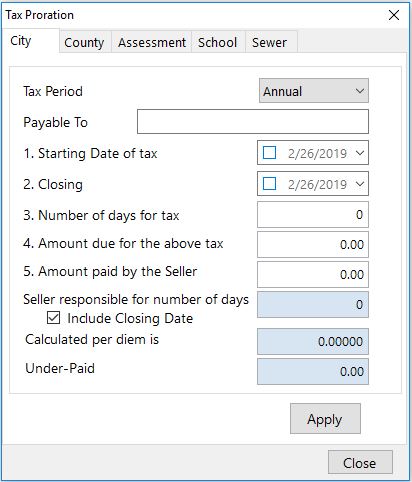

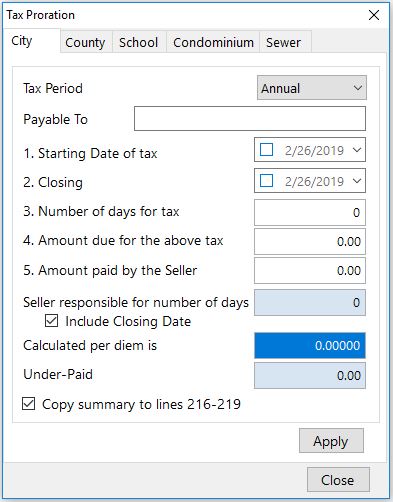

- Click on the appropriate tax type tab (City/County/School/Condominium/Sewer).

- Enter required values (dates, amount due, paid by seller)

- The program will compute seller over-paid/under-paid amounts. Once you are satisfied with the calculation, click on Apply.

- You will need to repeat these steps for each tax type.

**Tax proration amounts and dates will be entered onto the HUD (100 section for overpaid and 200 section for underpaid) and a summary will display in lines 216-219 (unless the box is unchecked)

CD Tax Proration HUD Tax Proration

Easysoft © 2019 Easysoft © 2019 |

|

|---|